are union dues tax deductible in nj

Because of the recent Supreme Court ruling in Janus v. You can deduct dues and initiation fees you pay for union membership.

For example if the CBA provides that union dues are calculated based on 35 of the employees gross wages then the contractor should multiply 35 by the employees gross wages.

. The most common structure - including Unit - sets dues as a percentage of gross earnings. Taking the standard deduction. In contrast if a taxpayer is self-employed and pays union dues then they are deductible as a business expense.

These are entered as unreimbursed employee expenses on Line 21 of Schedule A Form 1040 Itemized Deductions. June 4 2019 1112 PM. On smaller devices click the menu icon in the upper left-hand corner.

Unions comprised of governmental employees. With this new state tax benefit in effect it is projected to give back approximately 35 million to union members throughout New York State. American Federal of State County and Municipal Employees AFSCME.

Your contribution cannot be more than 75 of your annual health plan deductible 65 if you have a self-only plan. No employees cant take a union dues deduction on their return. The amount of union dues that you can claim is shown in box 44 of your T4 slips or on your receipts and includes any GSTHST you paid.

You can deduct dues and initiation fees you pay for union membership. Union members may still choose to pay their dues through a payroll deduction. However with the introduction of new tax reforms unreimbursed employee expense deductions have been eliminated.

To enter union dues in TaxAct. Members of the International Federation of Professional and Technical Engineers Local 21 pay 0. Prior to Janus the general law was that public sector unions ie.

AFSCME government workers are no longer forced to give part of each paycheck to highly political government unions as a condition of working in public service. An employee may authorize a payroll deduction by notifying hisher employer in writing. Employee union dues are no longer deductible in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act.

Elected officials of the union set union dues and typically hover around 1-2. The dues for persons eligible for active professional or active supportive membership who are on an approved unpaid leave of absence shall be one-half of the full dues for their respective membership category. Prior to that year a union member could write off yearly dues as an unreimbursed employee business expense.

Please note that tax payers can now itemize deductions on state taxes even if they do not itemize on federal taxes. Excess contributions that you withdraw before the due date of. Its important that you do not claim your tax deduction for union dues.

The TCJA made union dues non-tax deductible Prior to 2018 an employee who paid union dues may have been able to deduct unreimbursed employee business expenses including union dues. From within your TaxAct return Online or Desktop click on the Federal tab. The Supreme Courts ruling.

Four years have passed since union dues havent been deducted from federal taxes and many lawmakers are attempting to bring it back and make it deductible without itemizing. Prior to 2018 an employee who paid union dues prior may have been able to deduct them as unreimbursed employee business expenses if the total of the dues plus certain miscellaneous itemized expenses reached a certain level. The employees net pay is then reduced by any post-tax deductions including union dues donations to charity wage garnishments etc.

The bill the House passed would allow union members to deduct up to 250 of dues from their tax bills. The short answer is that dues may not be subtracted from taxable income in the tax years 2018 through 2025. What are typical union dues.

The employee then deducted the dues if the employee was able to itemize deductions. UNION DUES CANNOT BE DEDUCTED FROM GOVERNMENT EMPLOYEES IN New Jersey WITHOUT CONSENT. The deduction is above the line meaning filers can exclude the cost of dues from their.

The amount of union dues eligible to be claimed as a tax deduction is on your T4 slip in box 44. If dues are 1 workers pay 1 for every 100 earned. You can claim a tax deduction for these.

The Tax Fairness for Workers Act has been proposed to reinstate deductions for union dues and other employee expenses that are not reimbursed such as travel expenses and expenses for tools. Federally health insurance uses pretax funds union dues is subject to expenses in excess of 2 of AGI. Effective in 2019 union members can NOW deduct their union dues from state taxes provided they itemize deductions.

These are entered as unreimbursed employee expenses on Line 21 of Schedule A Form 1040 Itemized Deductions. This prohibition was written into the tax reform legislation passed by the US. Prior to the 2018 tax year workers were able to deduct union dues check-offs.

You may claim a tax deduction on line 21200 of your tax return and if your employer is a GSTHST registrant you may be able to claim a refund for a portion of your union dues. You would only get a benefit if other factors allowed you to itemize vs. The answer to your question is that the deduction for union dues and all employee expenses has been eliminated for tax years 2018 through 2025 regardless of whether an employee can itemize.

On June 27 2018 the United States Supreme Court issued an important employment law decision in the case of Janus v. Only unreimbursed expenses for books supplies and equipment that you purchased for classroom use qualify for the 250 Educator Expense deduction. Nothing in Janus impacts any agreements between a union and its members to pay union dues.

Union Members May Opt-Out of Paying Dues. New Jersey follows the federal rules for deducting qualified Archer MSA contributions.

What The Janus Decision Means For Payroll

How To Do Payroll In New Jersey

Become A Member Sea Seiu Local 1984

Become A Member Sea Seiu Local 1984

De Nj Nlg Prisoners Legal Advocacy Network Plan Mounts Legal Responses To Widespread Reports Of Prisoner Abuses In The Aftermath Of The 2018 National Prison Strike National Lawyers Guild

4 Work Tax Deductions For Advancing Your Career H R Block

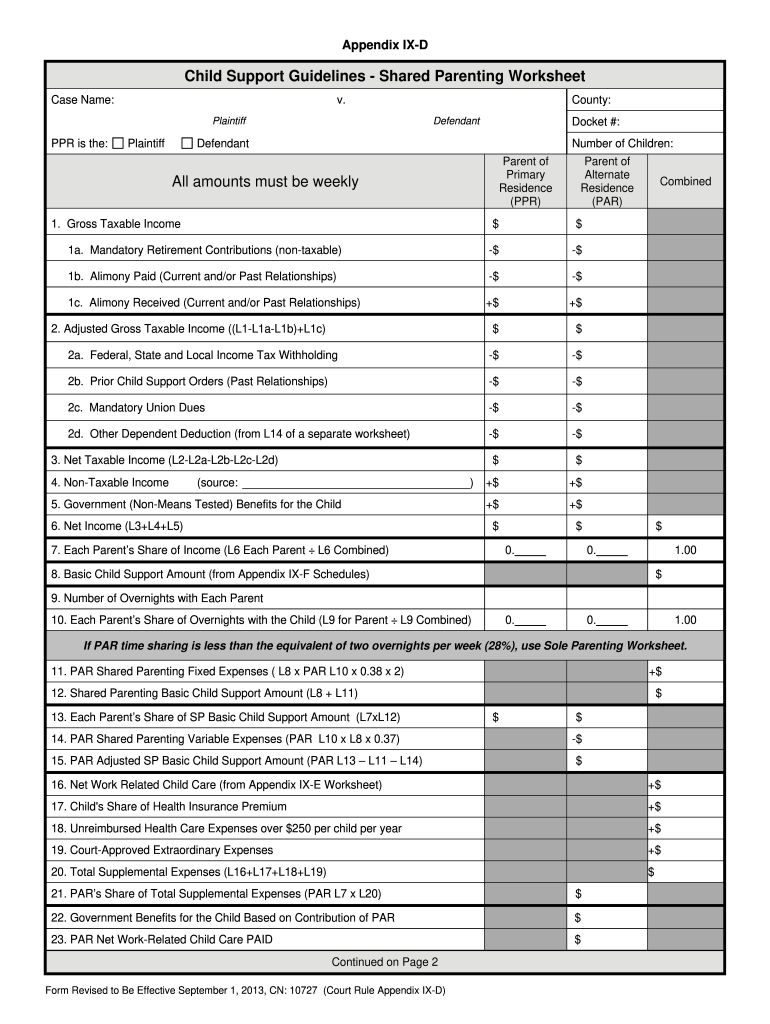

Nj Child Support Guidelines Shared Parenting Worksheet 2013 2022 Complete Legal Document Online Us Legal Forms

50 Tax Deductions You Didn T Know About Bandtax Com

What A Ba Should Know About Payroll Ppt Download

What A Ba Should Know About Payroll Ppt Download

Trenton Historical Society New Jersey

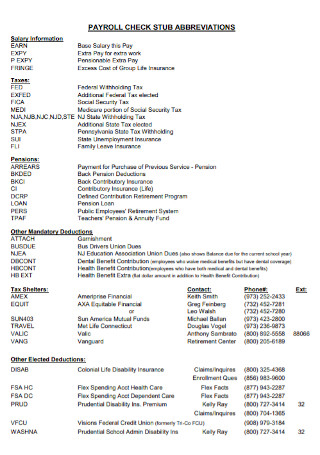

19 Sample Paycheck Slip Templates In Pdf Ms Word