inheritance tax changes 2021 uk

In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. On the 1 January 2022 The Inheritance Tax Delivery of Accounts Excepted Estates Amendment Regulations 2021 came in to force significantly changing the requirements for many Personal Representatives when administering smaller non-taxpaying estates.

Life Insurance And Inheritance Tax Forbes Advisor Uk

First it is important to highlight that these changes are good news as they will.

. INHERITANCE TAX could be set for significant changes which may impact gifts and allowances one expert has suggested ahead of the Budget. The aim is that from 1 January 2022 more than 90 of non-taxpaying estates will no longer have to complete. On death it has been suggested that there will be no tax free uplift the donee inherits at the donors base cost.

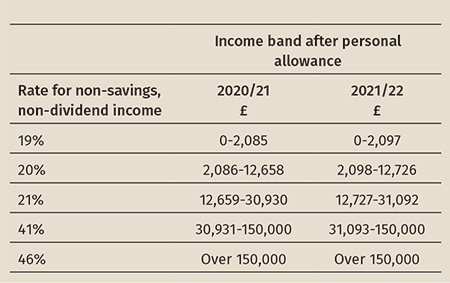

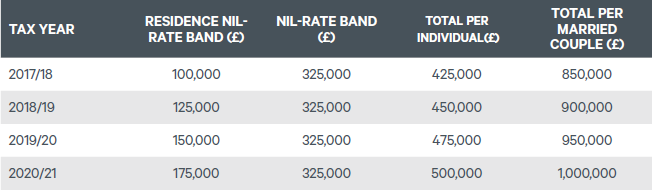

A 10 charge to tax. In 2021 the government implemented changes to the inheritance tax nil-rate band saying that current nil rate bands would remain at existing levels until April 2026. If the person died on or before 31 December 2021 no IHT205 form needs to be completed if it is an excepted estate or they do not need a probate.

Chancellor Rishi Sunak largely resisted the temptation to tinker with pension and inheritance taxes to fund his spending plans in his Autumn Budget on Wednesday. 0838 Sun Feb 28 2021. The Inheritance Tax charged will be 40 of 175000 500000 minus 325000.

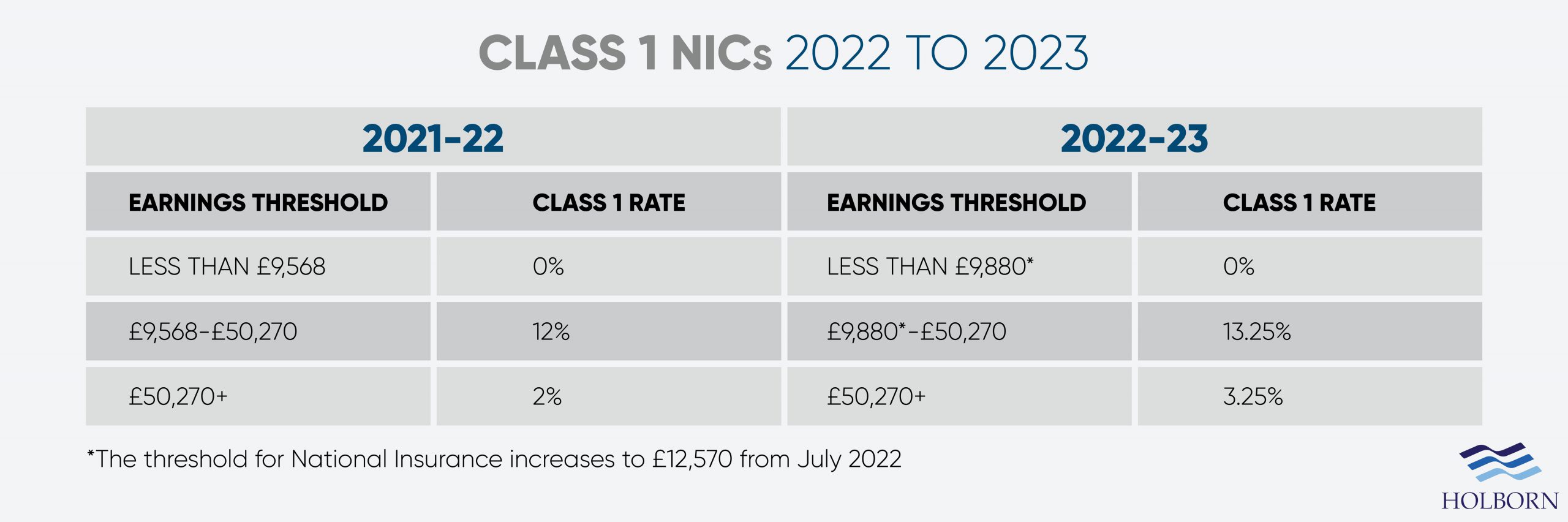

The extension to the previous 2004 regulations to include an updated definition of Excepted. Starting from 6th April 2022 the lower earnings limit will rise by 31. How much can you inherit without paying taxes in 2021.

Inheritance tax is charged at 40 and kicks in when the value of an estate rises above the 325000 threshold. Instead the donee will take over the base costs of the donor. However what is charged will be less if you leave behind your home to your direct descendants such as children or grandchildren.

For tax year 2017 the estate tax exemption was 549 million for an individual or twice that for a couple. However the new tax plan increased that exemption to 1118 million for tax year 2018 rising to 114 million for 2019 1158 million for 2020 117 million for 2021 and 1206. Most over 55s have no idea whether there might be inheritance tax IHT to pay on their estate or what the liability might be.

In some instances IHT bills could. For exempt estates the value limit in relation to the gross. Inheritance tax Currently an individual can pass on 325000 of their wealth tax-free to their loved ones.

Inheritance tax IHT is levied on an estate when a person has died and is passing on assets so long as the estate in question is valued higher than 325000. With change on its way understanding IHT may be more important now than ever. The 325000 IHT threshold or 650000 for married couples and civil partners has remained unchanged.

However it will be replaced with a 125 Heath and Social Care Levy. There is no federal inheritance tax but there is a federal estate tax. If capital gains tax rates are not aligned with income tax changes should be introduced to the taxation of share based rewards for employees and small business owners to increase the extent to which these are subject to income tax.

It may be worth accelerating actions you were planning to take anyway so you can avail of current thresholds and rates. In accordance with the new changes if a person has died on or after 1 January this year only the value of their estate needs to be reported when applying for a probate. By Rebekah Evans PUBLISHED.

Inheritance Tax Changes in 2022. That threshold can increase to 500000 if. An investor who bought Best Buy BBY in 1990 would have a gain.

Chartered Legal Executive Kat King discusses the changes that will take affect from 1 st January 2022 and who will be affected by these changes. The limit for chargeable trust property is increased from 150000 to 250000. Tax Day on 23 March 2021 announced that the excepted estates rules would be changed.

The rate increase will apply to. The future of inheritance tax. This will make it simpler for people taking out these policies in order to mitigate Inheritance Tax.

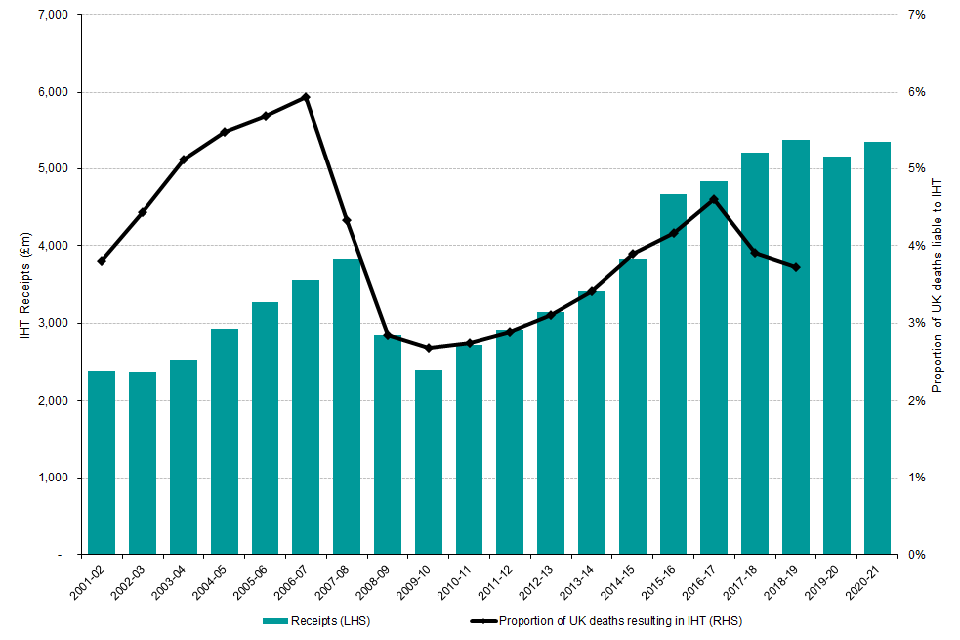

The most significant tax rises for investors could be those on gains pensions contributions and inheritance. In the current tax year 202223 no inheritance tax is due on the first 325000 of an estate with 40 normally being charged on any amount above that. ICAEW technical editor Lindsey Wicks looks at the effects as more than 90 of non-taxpaying estates will no longer have to complete full inheritance tax accounts.

From 2023 the rate of National Insurance will return to 202122 levels. Prior to announcing the Autumn. 15 October 2021 1423.

The annual exempt amount could be reduced from 12300 per annum to between 2000 and 4000 a dramatic. HM Revenue Customs- HMRC have recently announced they will be changing the reporting requirements in respect of deceased persons estates. Reducing the IHT tax rate of 40 to a rate of 10 for estates up to 2m 20 for estates over 2m.

Under the EU Succession Regulation the law of the place of residence on death is presumed to govern inheritance so if France is the deceaseds place of residence French law will apply to hisher world-wide estate as the effect of the new law will be to disregard the deceaseds possible choice of hisher national law made by will. The All-Party Parliamentary Group for Inheritance Intergenerational Fairness APPG IIF has proposed to reduce the current charge to IHT from 40 to 10 abolish IHT in its current form and replace it with an entirely new system. The estate can pay Inheritance Tax at a reduced rate of 36 on some assets if.

Ad Inheritance Guidance is Just One of the Benefits of Wealth Planning. Targeted at multimillionaires and billionaires this proposal imposes a new death tax on many families with long term investments. There is also a 175000 allowance for.

For lifetime gifts there would be no capital gains tax on the gift.

Inheritance Tax Statistics Commentary Gov Uk

Will There Be Changes To Inheritance Tax Following Covid 19

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

Inheritance Tax 2022 Pensions Could Be Targeted By Rishi Sunak In Spring Statement Personal Finance Finance Express Co Uk

How Much Inheritance Tax Will I Pay In 2022 And How Can I Reduce Or Avoid It

Uk And Ireland Impose Highest Taxes On Inheritance Of All Major Economies Uhy Internationaluhy International

January 2022 Inheritance Tax Changes All You Need To Know Key Business Consultants

Changes To Uk Tax In 2022 Holborn Assets

Tolley S Inheritance Tax 2021 22 Lexisnexis Uk

Inheritance Tax Advice For British Expats And Non Uk Residents

How Potential Changes To Inheritance Tax Capital Gains Tax During The Upcoming April 2022 Budget May Affect You Mlp Law

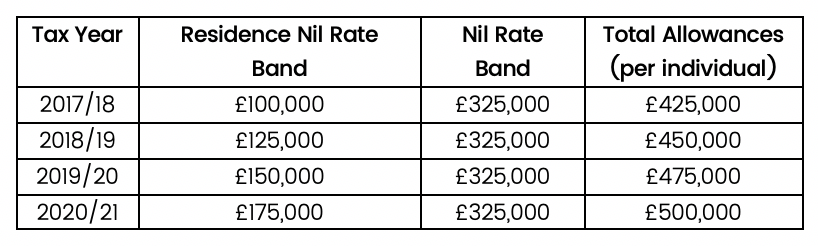

Inheritance Tax The Residence Nil Rate Band

Prepare For Potential Changes To Inheritance Tax

Pfp The Rise And Rise Of Inheritance Tax

Inheritance Tax Planning Guide 2021 22

Inheritance Tax A Uk Guide Raisin Uk

Inheritance Tax Threshold Frozen Until 2026 But Why Is Iht Planning Still Important Company News Wollens